The Corporation and its subsidiary, Riverview Bank, entered into a Director Emeritus Agreement (the “Agreement”) with its “founding” directors, effective November 2, 2011. In order to promote the orderly succession of the Board of Directors, the Agreement defines the benefits the Bank is willing to provide upon the termination of service as a director to those individuals who were directors of the Corporation as of December 31, 2011, providedas long as the director provides the services contemplated in the Agreement. The material terms of the Agreement are as follows:

The Bank will pay the director or the director’s beneficiary $15,000 per year, which may be increased at the sole discretion of the Board of Directors, for five years, payable in equal monthly installments in the following circumstances:

Upon termination of service as a director due to a disability prior to the age of 65;

If the director is active as a director or director emeritus as of the date of a change in control of the Bank or the Corporation (as defined in Section 409A of the Internal Revenue Code), upon termination of services as a change indirector on or after the ownershipage of 65, provided the director has 10 or effective controlmore years of continuous services at the Corporation or the Bank;date of termination;

Upon the death of a director after electing to be a director emeritus.

Some of the Corporation’s directors and executive officers and the companies with which they are associated were customers of, and had banking transactions with, the Corporation’s subsidiary bank, Riverview Bank, during 2016.2019. All loans and loan commitments made to them and to their companies were made in the ordinary course of business, on substantially the same terms, including interest rates, collateral and repayment terms, as those prevailing at the time for comparable transactions with other customers of the Bank, and did not involve more than a normal risk of collectability or present other unfavorable features. The Corporation anticipates that Riverview Bank will continue to enter into similar transactions with its officers and directors in the future.

The Board of Directors must approve all related party transactions that are significant. In turn, the director or officer in question is excused from the Board meeting at the time approval of a related party transaction is considered by the Board.

Payments made during 20162019 and 20152018 to any director who is a partner in, or a controlling shareholder, or an executive of an organization that has made payments to, or received payments from, the Corporation or Bank payments for property or services have been for amountswere made within NASDAQ guidelines defining the director independence and were below the applicable SEC threshold for disclosure as a related party transaction.

The Audit Committee has:

reviewed and discussed the Corporation’s audited consolidated financial statements as of and for the year ended December 31, 20162019 with management and with Dixon Hughes GoodmanCrowe LLP (“Crowe”), the Corporation’s independent registered public accounting firm for 2016;2019;

discussed with Dixon Hughes Goodman LLPCrowe the matters required underby the applicable professional auditing standards and regulations byrequirements of the Public Company Accounting Oversight Board in Auditing Standard No. 16 “Communication with Audit Committees”.(“PCAOB”) and the Securities and Exchange Commission;

received the written disclosures and the letter from Dixon Hughes Goodman LLPCrowe required by applicable requirements of the PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence” and has discussed with Dixon Hughes Goodman LLP,Crowe, which is independent from the Corporation and its management; and

recommended, based on the reviews and discussions referred to above, to the Board of Directors that the audited financial statements be included in the Corporation’s Annual Report on Form10-K for the year ended December 31, 2016 for filing2019 filed with the SEC.

By the members of the Audit Committee of the Board of Directors:

Timothy E. Resh

Marlene K. Sample

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTACCOUNTING FIRM

Smith Elliott Kearns & Company, LLC (“SEK”) was the Corporation’s independent registered public accounting firm for 2015On December 20, 2018, Riverview Financial Corporation, after review and the first eight months in 2016. On June 9, 2016, the Corporation received notice from SEK that SEK would not be able to meet the requirements set forth in the Public Company Accounting Oversight Board for audit firm partner rotation for periods ending after fiscal year 2016. In addition, SEK recommended that the Corporation’s Audit Committee should begin a formal process to engage another independent registered public accounting firm and stated they would fully cooperate with the audit transition. As a result, Riverview did, in fact, engage in a formal process to seek another independent registered public accounting firm. As a resultrecommendation of that process, on August 25, 2016, the Audit Committee of the Corporation’s Board of Directors, through a formal proposal process, determined to dismiss SEK and engaged Dixon Hughes Goodmanappointed Crowe LLP to serve(“Crowe”) as itsthe Corporation’s new independent registered public accounting firm for and with respect to the fiscal year ending December 31, 2016.2019. The Corporation dismissed Dixon Hughes Goodman LLC (“DHG”) from that role following the issuance of the Corporation’s audited financial statements and filing of its Annual Report on Form10-K for the year ended December 31, 2018.

The reportsreport issued by DHG and SEK in connection with the audit of the Corporation for the yearsyear ended December 31, 2016 and 20152018 did not contain an adverse opinion or disclaimer of opinion, nor was suchthis report qualified or modified as to uncertainty, audit scope, or accounting principles.

Furthermore, for the yearsyear ended December 31, 2016 and 2015, and the interim periods ended March 31, 2016, June 30, 2016 and September 30, 2016,2018, there were no “disagreements” (as such term is defined within the meaning of Item 304(a)(1)(iv) of Regulation S-K)disagreements with either DHG or SEK on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure.procedure, which disagreements, if not resolved to the satisfaction of DHG, would have caused DHG to make reference to the subject matter of the disagreements in its reports on the consolidated financial statements of the Corporation for such year. During the yearsyear ended December 31, 2016 and 2015,2018, there were no “reportable events” as such term is defined within the meaning of Item 304(a)(1)(v) of Regulation S-K.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On August 25, 2016, the Audit Committee of the Board of Directors engaged Dixon Hughes Goodman LLP (“DHG”) to serve as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2016. Prior to engaging DHG,Crowe, the Corporation did not consult DHGwith Crowe regarding the application of accounting principles to a specific completed or contemplated transaction or regarding the type of audit opinions that might be rendered by DHGCrowe on the Corporation’s financial statements, and DHGCrowe did not provide any written or oral advice that was an important factor considered by the Corporation in reaching a decision as to any such accounting, auditing or financial reporting issue. DHG does not have a material relationship with

The Audit Committee has approved the Corporation orengagement of Crowe for the Bank and is consideredyear ending December 31, 2020, subject to be well qualified.the ratification of the Corporation’s shareholders.

Representatives of DHG are expected to be present at the Annual Meeting. While DHG representatives will not have an opportunity to make a statement, they will be available to respond to appropriate questions.

Aggregate fees billed by the respective accounting firmsCrowe and DHG for services respectively rendered in the aggregate for the years ended December 31, 20162019 and 20152018 were as follows:

| DHG | SEK | |||||||||||

| 2016 | 2016 | 2015 | ||||||||||

Audit fees(1) | $ | 135,000 | $ | 39,215 | $ | 74,495 | ||||||

Audit-related fees(2) | — | 13,055 | 11,210 | |||||||||

Tax fees(3) | — | 15,805 | 10,490 | |||||||||

All other fees(4) | — | 5,341 | — | |||||||||

|

|

|

|

|

| |||||||

Total | $ | 135,000 | $ | 73,416 | $ | 96,195 | ||||||

|

|

|

|

|

| |||||||

| Crowe | DHG | |||||||

| 2019 | 2018 | |||||||

Audit fees(1) | $ | 225,000 | $ | 227,457 | ||||

Tax fees(2) | 18,800 | — | ||||||

All other fees(3) | 1,000 | 9,200 | ||||||

|

|

|

| |||||

Total | $ | 244,800 | $ | 236,657 | ||||

|

|

|

| |||||

| (1) | Audit fees include fees for the audit of the Corporation’s consolidated financial statements and interim reviews of the Corporation’s quarterly financial statements, comfort letters, consents and other services related to Securities and Exchange Commission matters. |

| (2) |

Tax fees were for professional services rendered for preparation of the Corporation’s corporate tax returns and other tax compliance issues. |

Other fees were for consultations concerning general accounting issues. |

The Audit Committeepre-approves all auditauditing and permittednon-auditing services, including the fees and terms thereof, to be performed by its independent auditor, subject to thede minimus exceptions fornon-auditing services permitted by the Exchange Act. However, these types of services are approved prior to completion of the services. The Audit Committeepre-approved all audit and permissiblenon-audit services provided by the independent auditors in 2016.2019. These services may include audit services, audit related services, tax services and other services. The Audit Committee pre- approvalpre-approval process is generally provided for up to one year and anypre-approval is detailed as to the particular service or category of services and is subject to a specific budget. In addition, the Audit Committee may alsopre-approve particular services on acase-by-case basis. For each proposed service, the independent auditor is required to provide detailed backup documentation at the time of approval.

Although shareholder approval offor the selection of DHGCrowe is not required by law, the Board of Directors believes that it is advisable to give shareholders an opportunity to ratify this selection as is a common practice among other publicly traded companies and consistent with sound corporate governance practices. If Riverview’s shareholders do not approve this proposal at the 20172020 Annual Meeting, the Audit Committee will consider the results of the shareholder vote on this proposal when selecting an independent auditor for 2018,2021, but no determination has been made as to what action, if any, the Audit Committee would take if shareholders do not ratify the appointment of DHG.Crowe. Representatives from Crowe are expected to be present at the Annual Meeting. While Crowe representatives will not have an opportunity to make a statement, they will be available to respond to appropriate questions.

The Board of Directors recommends that shareholders vote FORratification of the appointment of Dixon Hughes GoodmanCrowe LLP as the Corporation’sCorporation’s independent auditorregistered public accounting firm for the fiscal year ending December 31, 2017.2020.

The Corporation’s 2016 Annual Report on Form 10-K for the year ended December 31, 2016 is being mailed with this proxy statement. Any shareholder may obtain a copy of Riverview Financial Corporation’s Annual Report for the year ended December 31, 2016,2019, without charge, by submitting a written request to Scott A. Seasock, Chief Financial Officer of Riverview Financial Corporation, 3901 North Front Street, Harrisburg Pennsylvania 17110. The Form 10K10-K is also available on the Corporation’s website athttps://www.riverviewbankpa.comwww.riverviewbankpa.com/ then clicking on theInvestor Relations link under Investor Relations.the “Annual Reports” heading.

As of the date of this proxy statement, the Board of Directors knows of no matters other than those discussed in this proxy statement that will be presented at the Annual Meeting. However, if any other matters are properly brought before the meeting, any proxy given pursuant to this solicitation will be voted in accordance with the recommendations of the Board of Directors.Directors and as permitted by applicable SEC rules.

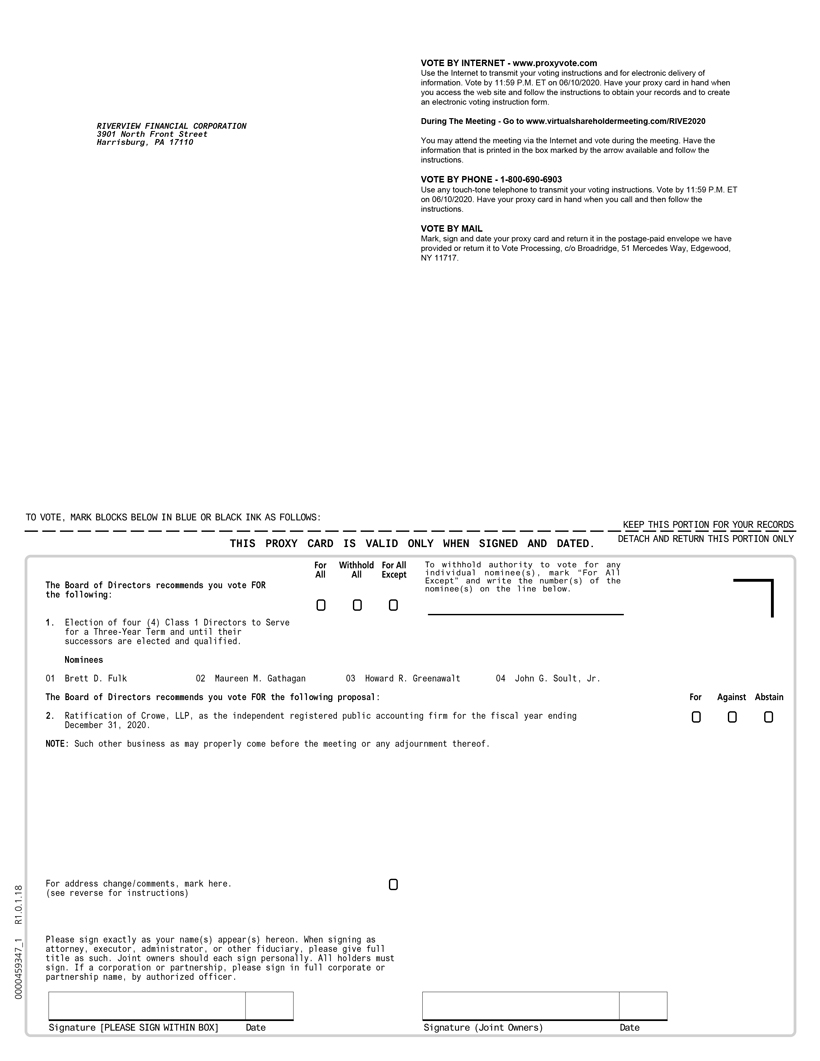

b.RIVERVIEW FINANCIAL CORPORATION 3901 North Front Street Harrisburg, PA 17110 VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 P.M. ET on 06/10/2020. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/RIVE2020 You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 P.M. ET on 06/10/2020. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. The Board of Directors may issue, in one or more classes or series, sharesrecommends you vote FOR the following: 1. Election of Preferred Stock, with full, limited, multiple, fractional or no voting rights,four (4) Class 1 Directors to Serve for a Three-Year Term and with such designations, preferences, qualifications, privileges, limitations, restrictions, options, conversion rights or other special or relative rights as shall be fixed from timeuntil their successors are elected and qualified. For Withhold For All All All Except To withhold authority to time byvote for any individual nominee(s), mark “For All Except” and write the Boardnumber(s) of Directors. Except as otherwise provided in any resolution or resolutions of the nominee(s) on the line below. Nominees 01 Brett D. Fulk 02 Maureen M. Gathagan 03 Howard R. Greenawalt 04 John G. Soult, Jr. The Board of Directors providingrecommends you vote FOR the following proposal: 2. Ratification of Crowe, LLP, as the independent registered public accounting firm for the issuancefiscal year ending December 31, 2020. NOTE: Such other business as may properly come before the meeting or any adjournment thereof. Nominees For Against Abstain For address change/comments, mark here. (see reverse for instructions) Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date 0000459347_1 R1.0.1.18

Important Notice Regarding the Availability of any particular class or series of Preferred Stock, (i) the number of shares of stock of any such class or series so set forth in such resolution or resolutions may be increased or decreased (but not below the number of shares of such class or series then outstanding) by a resolution or resolutions adopted by the Board of Directors; and (ii) Preferred Stock redeemed or otherwise acquired by the Corporation shall assume the status of authorized but unissued Preferred Stock, shall be unclassified as to class or series and may thereafter, subject to the provisions of this Article 5 and to any restrictions contained in any resolution or resolutions of the Board of Directors providingProxy Materials for the issueAnnual Meeting: The Notice & Proxy Statement, Annual Report is/ are available at www.proxyvote.com RIVERVIEW FINANCIAL CORPORATION Annual Meeting of any such class or series of Preferred Stock, be reissued in the same manner as other authorized but unissued Preferred Stock.

1. Definitions.

2. Designation; Number of Shares. The class of shares of capital stock hereby authorized shall be designated as “Non-Voting Common Stock” (the “Non-Voting Common Stock”). The number of authorized shares of the Non-Voting Common Stock shall be 1,348,809 shares. The Non-Voting Common Stock shall have no par value. Each share of Non-Voting Common Stock has the designations, preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends, qualifications, or terms or conditions of redemption as described herein. Each share of Non-Voting Common StockShareholders June 11, 2020 10:00 AM This proxy is identical in all respects to every other share of Non-Voting Common Stock.

3. Dividends. The Non-Voting Common Stock will rankpari passu with the Common Stock with respect to the payment of dividends or distributions, whether payable in cash, securities, options or other property, and with respect to issuance, grant or sale of any rights to purchase stock, warrants, securities or other property (collectively, the “Dividends”). Accordingly, the holders of record of Non-Voting Common Stock will be entitled to receive as, when, and if declaredsolicited by the Board of Directors Dividends in the same per share amount as paid on the Common Stock, and no Dividends will be payable on the Common Stock or any other class or series of capital stock ranking with respect to Dividendspari passu with the Common Stock unless a Dividend identical to that paid on the Common Stock is payable at the same time on the Non-Voting Common Stock in an amount per share of Non-Voting Common Stock equal to the product of (i) the per share Dividend declared and paid in respect of each share of Common Stock and (ii) the number of shares of Common Stock into which such share of Non-Voting Common Stock is then convertible (without regard to any limitations on conversion of the Non-Voting Common Stock);provided however, that if a stock Dividend is declared on Common Stock payable solely in Common Stock, the holders of Non-Voting Common Stock will be entitled to a stock Dividend payable solely in shares of Non-Voting Common Stock. Dividends that are payable on Non-Voting Common Stock will be payable to the holders of record of Non-Voting Common Stock as they appear on the stock register of the Corporation on the applicable record date, as determined by the Board of Directors, which record date will be the same as the record date for the equivalent Dividend of the Common Stock. In the event that the Board of Directors does not declare or pay any Dividends with respect to shares of Common Stock, then the holders of Non-Voting Common Stock will have no right to receive any Dividends.

4. Liquidation.

5. Conversion.

6. Adjustments.

|

7. Reorganization, Mergers, Consolidations or Sales of Assets. If at any time or from time to time there will be a capital reorganization of the Common Stock (other than a subdivision, combination, reclassification or exchange of shares otherwise provided for in Section 6) or a merger or consolidation of the Corporation with and into another corporation, or the sale of all or substantially all the Corporation’s properties and assets to any other Person, then, as a part of such reorganization, merger, consolidation or sale, provision will be made so that the holders of the Non-Voting Common Stock will thereafter be entitled to receive upon conversion of the Non-Voting Common Stock, the number of shares of stock or other securities or property of the Corporation, or of the successor company resulting from such merger or consolidation or sale, to which a holder of that number of shares of Common Stock deliverable upon conversion of the Non-Voting Common Stock would have been entitled to receive on such capital reorganization, merger, consolidation or sale (without regard to any limitations on conversion of the Non-Voting Common Stock).

8. Redemption. Except to the extent a liquidation under Section 4 may be deemed to be a redemption, the Non-Voting Common Stock will not be redeemable at the option of the Corporation or any holder of Non-Voting Common Stock at any time. Notwithstanding the foregoing, the Corporation will not be prohibited from repurchasing or otherwise acquiring shares of Non-Voting Common Stock in voluntary transactions with the holders thereof, subject to compliance with any applicable legal or regulatory requirements, including applicable regulatory capital requirements. Any shares of Non-Voting Common Stock repurchased or otherwise acquired may be reissued as additional shares of Non-Voting Common Stock.

9. Voting Rights. The holders of Non-Voting Common Stock will not have any voting rights, except as may otherwise from time to time be required by law.

10. Protective Provisions. So long as any shares of Non-Voting Common Stock are issued and outstanding, the Corporation will not (including by means of merger, consolidation or otherwise), without obtaining the approval (by vote or written consent) of the holders of a majority of the issued and outstanding shares of

Non-Voting Common Stock, (i) alter or change the rights, preferences, privileges or restrictions provided for the benefit of the holders of the Non-Voting Common Stock, (ii) decrease the authorized number of shares of Non-Voting Common Stock or (iii) enter into any agreement, merger or business consolidation, or engage in any other transaction, or take any action that would have the effect of changing any preference or any relative or other right provided for the benefit of the holders of the Non-Voting Common Stock. In the event that the Corporation offers to repurchase shares of Common Stock from its shareholders in general, the Corporation shall offer to repurchase shares of Non-Voting Common Stock pro rata based upon the number of shares of Common Stock such holders would be entitled to receive if such shares were converted into shares of Common Stock immediately prior to such repurchase.

11. Notices. All notices required or permitted to be given by the Corporation with respect to the Non-Voting Common Stock shall be in writing, and if delivered by first class United States mail, postage prepaid, to the holders of the Non-Voting Common Stock at their last addresses as they shall appear upon the books of the Corporation, shall be conclusively presumed to have been duly given, whether or not the holder actually receives such notice; provided, however, that failure to duly give such notice by mail, or any defect in such notice, to the holders of any stock designated for repurchase, shall not affect the validity of the proceedings for the repurchase of any other shares of Non-Voting Common Stock, or of any other matter required to be presented for the approval of the holders of the Non-Voting Common Stock.

12. Record Holders. To the fullest extent permitted by law, the Corporation will be entitled to recognize the record holder of any share of Non-Voting Common Stock as the true and lawful owner thereof for all purposes and will not be bound to recognize any equitable or other claim to or interest in such share or shares on the part of any other Person, whether or not it will have express or other notice thereof.

13. Term. The Non-Voting Common Stock shall have perpetual term unless converted in accordance with Section 5.

14. No Preemptive Rights. The holders of Non-Voting Common Stock are not entitled to any preemptive or preferential right to purchase or subscribe for any capital stock, obligations, warrants or other securities or rights of the Corporation, except for any such rights that may be granted by way of separate contract or agreement to one or more holders of Non-Voting Common Stock.

15. Replacement Certificates. In the event that any Certificate will have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such Certificate to be lost, stolen or destroyed and, if required by the Corporation, the posting by such Person of a bond in such amount as the Corporation may determine is necessary as indemnity against any claim that may be made against it with respect to such Certificate, the Corporation or the Exchange Agent, as applicable, will deliver in exchange for such lost, stolen or destroyed Certificate a replacement Certificate.

16. Other Rights. The shares of Non-Voting Common Stock have no preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends, qualifications, or rights, other than as set forth herein or as provided by applicable law.

RIVERVIEW FINANCIAL CORPORATION

REVOCABLE PROXY

FOR ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 21, 2017

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

The undersigned hereby constitutes and appoints Howard R. Greenawalt and Joseph D. Kerwin and Marlene K. Sample and either of them, proxies of the undersigned, with full power of substitution to vote all of the shares of Riverview Financial CorporationRIVERVIEW FINANCIAL CORPORATION that the undersigned shareholder may be entitled to vote at the annual meetingAnnual Meeting of shareholdersShareholders to be held on Wednesday,Thursday June 21, 2017,11, 2020, at 10:00 a.m.,AM, local time, via a live webcast at the Hershey Country Club, 1000 East Derry Road, Hershey, Pennsylvania, 17033,www.virtualshareholdermeeting.com/RIVE2020, and at any adjournment or postponement of the meeting as follows:

1. Election of three (3) Class 1 Directors to Serve for a Three-Year Term and until their successors are elected and qualified (except as marked to the contrary below):

| ||||

|

Instruction: To withhold authority to vote for any individual nominee, mark “For All Except” and write that nominee’s name on the space provided below:

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES NAMED ABOVE, ALONG WITH A VOTE “FOR” PROPOSALS 2, 3 and 4.

thereof. This proxy, when properly signed and dated, will be voted in the manner specified by the undersigned. If no specification is made, this proxy will be voted FOR the nominees and proposals listed above.

Dated: , 2017

|

|

|

|

Numberon the reverse side of Shares Held of Recordthis form. Address change/comments: (If you noted any Address Changes and/or Comments above, please mark corresponding box on April 14, 2017: the reverse side.) Continued and to be signed on reverse side 0000459347_2 R1.0.1.18